What are Options?

"Oh, your fund trades options? I'm not very familiar with options. Can you explain what they are?"

This is a question I get frequently. So, I thought I'd give a high-level overview of what options are so you can start to explore the possibilities these incredible products offer and learn how to use them in your own investment portfolio.

Let’s get started!

In the most basic sense, an option is a financial contract.

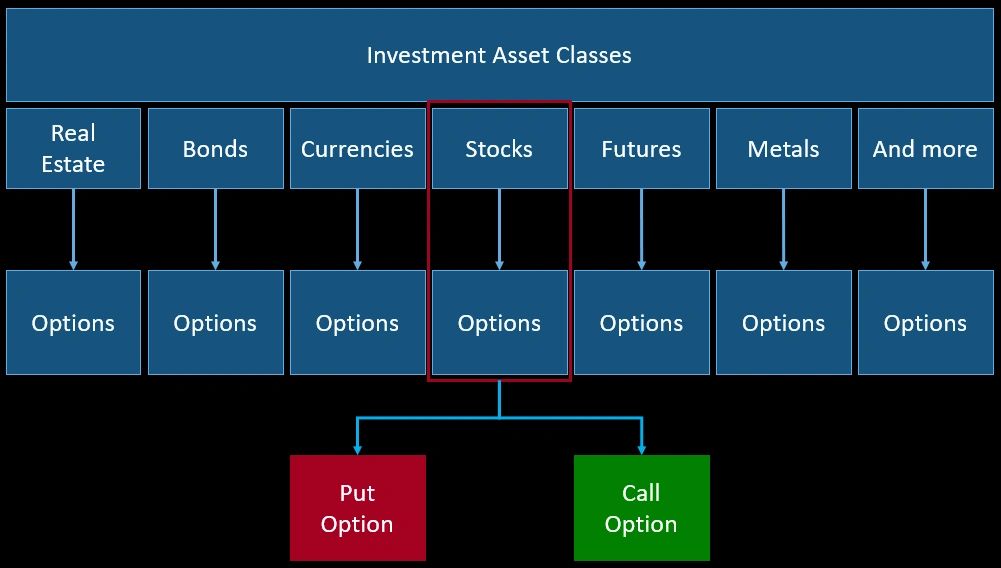

There are options available on many asset classes such as real estate, stocks, forex, etc. For simplicity, we will focus only on equity options (technical term for options on stocks).

Based on changes in a stock's price, these option contracts change in value. Options are a type of financial derivative because they “derive” their value from a certain stock. This stock is known as "the underlying".

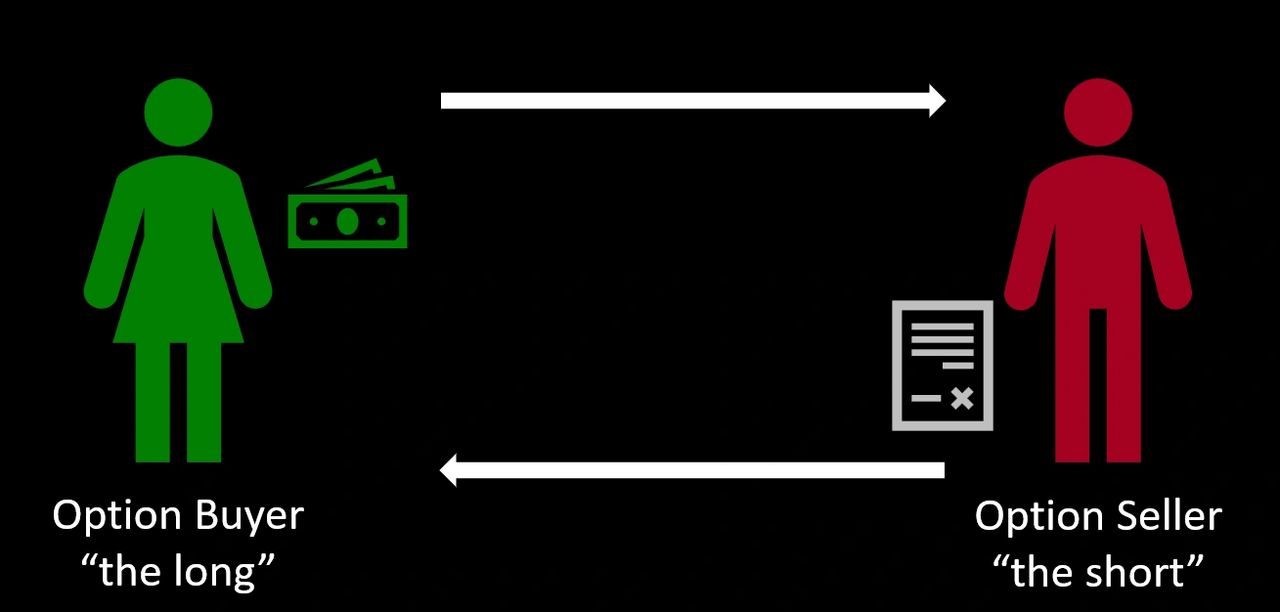

The option contract has two parties (as most contracts often do):

- The buyer (also known as the long)

- The seller (also known as the short or the writer)

The buyer pays the seller for this financial contract.

The seller, in turn, writes a contract (that’s why they’re also known as the writer).

The contract gives the buyer certain financial rights.

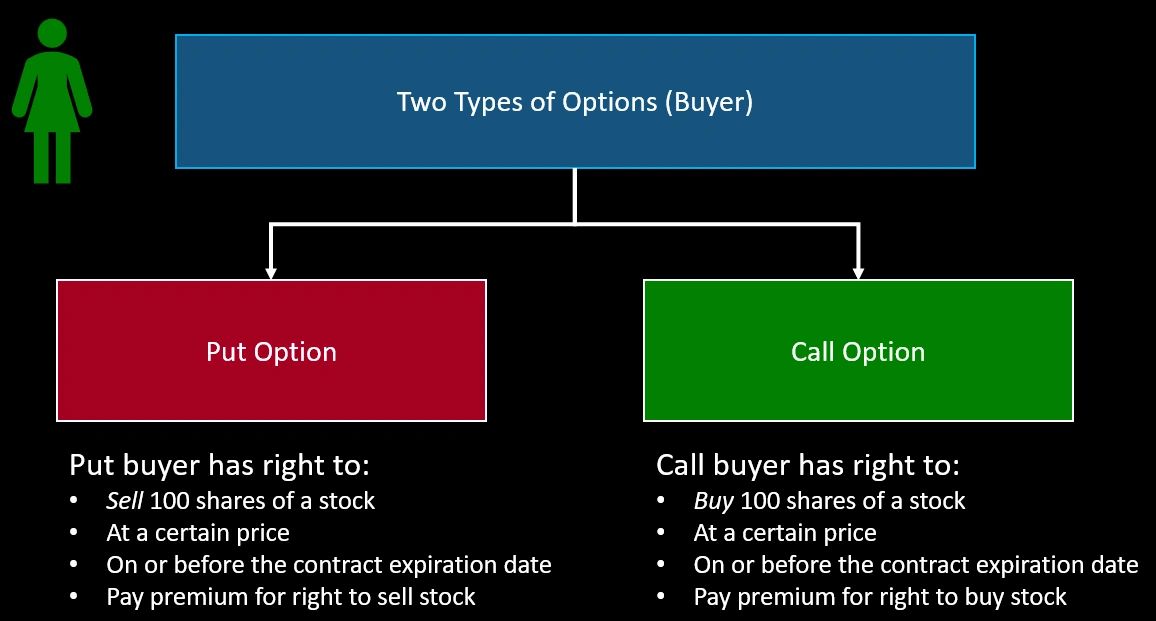

Before we go into these “rights,” we must learn about the two types of options as each one gives different rights to the option buyer. The two types of option contracts are:

- Call option

- Put option

The call option gives the buyer of the contract the right, but not the obligation to:

- Buy 100 shares of a stock

- At a certain price

- On or before the expiration date

The put option has a very similar definition except there’s one major difference.

The put option gives the owner of the contract the right, but not the obligation to:

- Sell 100 shares of a stock

- At a certain price

- On or before the expiration date

Do you see the difference? The only difference between a call option and a put option is that:

- The call option gives you the right, to buy a stock.

- The put option gives you the right, to sell a stock.

As there is always a buyer and a seller in every market, to help keep these definitions straight, think of these from the option buyer's perspective.

To obtain the rights described above, the option buyer must pay ‘a premium’ to the option seller.

Confused? Don't worry - this will all make sense as we continue reading below.

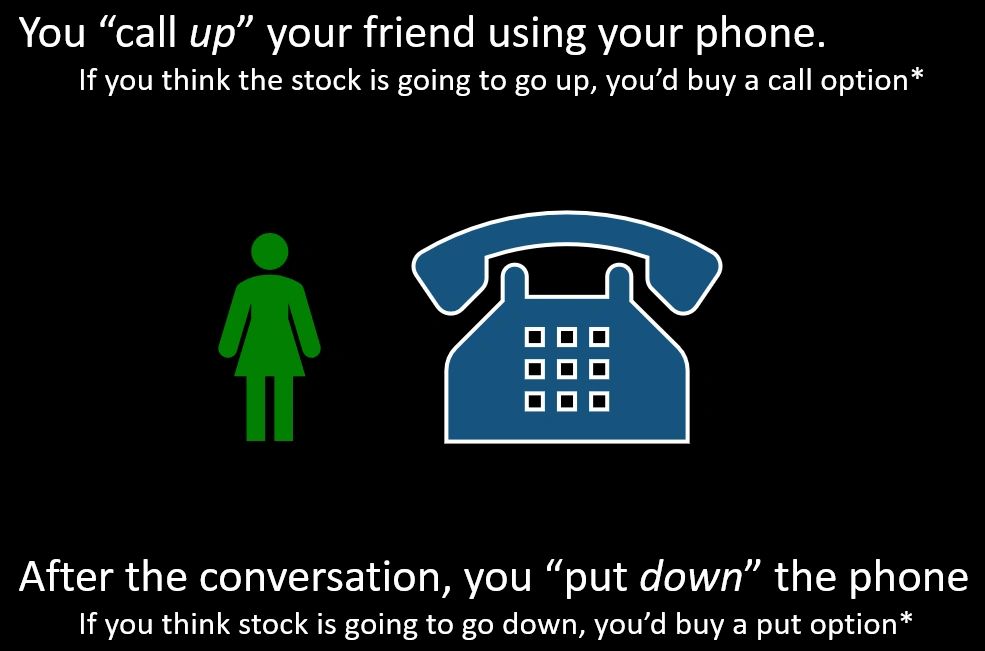

To help you remember the difference between a call option and a put option, pretend you have a phone in your hand.

1. You ‘call up’ your friend.

2. After the conversation, you ‘put down’ the phone.

Basically, if you think the stock is going to go up in price, you can “call up” your friend. In other words, you’d buy a call option if you think the stock is going to go up.

If you think the stock is going to go down in price, you’d “put down” the phone after the call. In other words, you’d buy a put option if you think the stock is going to go down.

*This next part is an extremely important concept so don’t skip it.

*Just because you think the stock is going to go up, it doesn’t mean you should buy a call option. There are many factors that come to play (it’ll be explained in future articles). I’m only telling you to buy a call option if you think the stock will go up to help you understand the differences. It’s not actually investment advice on what you should do.

*Similarly, just because you think a stock is going to go down, it doesn’t mean you should buy a put option. This will make a lot more sense once I explain something known as the “Option Greeks” in future articles. At this time, it’s a little out of the scope of this article, so let’s continue.

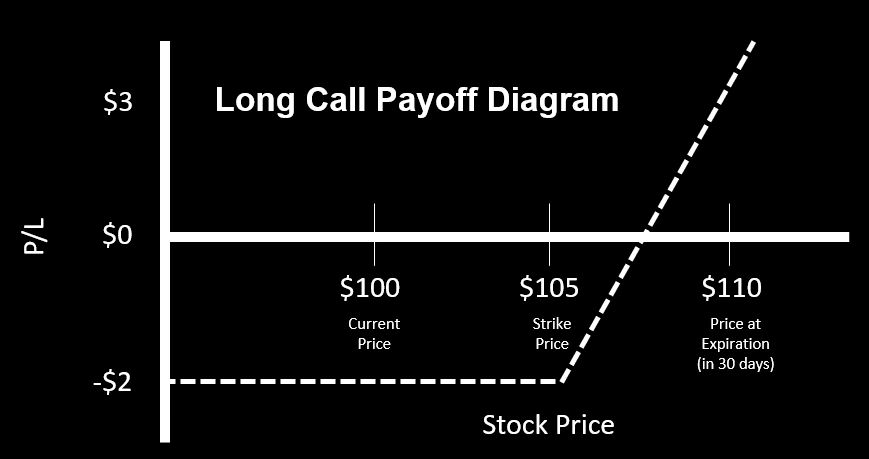

Let’s go back to the call option. Let’s say a stock is at $100. You buy a call option with a $105 strike price and pay a $2 premium to the option seller to do so.

Before moving forward, let’s talk about the strike price.

If you scroll up and look at the second part of the option definition, the call option gives you the right, but not the obligation to buy 100 shares of the stock “at a certain price.” The strike price is that certain price.

And I know your next question is when is the expiration date? So let’s answer that here as well.

The expiration dates vary based on the type of security you’re trading, but for simplicity, they range from expiring today all the way to expiring in a few years. You as a trader can decide which expiration date you’d like to trade at. Picking the expiration date is out of the scope for this article so make sure to subscribe and you’ll get notified when that article is published.

For the rest of this article, let’s assume the expiration date is 30 days from now. Again, this isn’t what you should do, it’s just hypothetical.

Now that we’ve touched upon the strike price and expiration date, let’s move on.

For convenience, here's the hypothetical scenario so you don't need to scroll up: Let’s say a stock is at $100. You buy a call option with a $105 strike price, expiring in 30 days, and pay a $2 premium to the option seller to do so.

If the stock is trading at $110 in 30 days (at the expiration date), it means you can buy 100 shares at $105 and sell the stock in the open market for $110.

You’d make a $3 profit/share ($110 stock price at expiration - $105 strike price - $2 premium paid for the call option right).

In reality, you’d make $300 minus commissions and fees, because remember, each contract is for 100 shares.

What happens if you don’t have the cash to buy 100 shares at $105?

No worries. The option contract itself would have gained in value to net you almost the $300 profit. You can sell the contract in the open market to another market participant instead of exercising your right to buy the stock and selling the exercised stock in the market.

But it ultimately depends on your strategy and what you’d like to do with the underlying.

What happens if the stock is at $103 at the expiration date?

Because you had the right to buy the stock at $105, you wouldn’t exercise your right to buy the stock as you can readily buy the same stock in the open market for $103.

Therefore, your option contract would expire worthless, and you’d have just lost the $2 premium you paid.

Enjoying the article?

Follow me on Instagram: @RealVijayKailash

Connect with me on LinkedIn: Vijay Kailash, CFA

A real-world example to compare a call option against is the due diligence fee for buying a house. If you're not familiar with buying a house, the interested buyer pays a fee (an option premium) to the house seller for the due diligence period.

During this time, the buyer can bring in an inspector etc. to make sure the property doesn't have any major issues. At the end of the due diligence period (option expiration date), the potential buyer of the house has the right, but not the obligation to continue the transaction to buy the house. However, in this scenario, the house seller is obligated to sell the house (if the buyer wishes to continue) - they don't have a choice as they entered into the contract and collected a fee to do so.

If for some reason the potential buyer sees major issues with the house (plumbing issues, for example), they can back out from buying the house and they'll only lose the due diligence fee. The house seller gets to keep the due diligence fee as compensation.

Now that we've covered the basics of call options, let’s walk through a quick example using put options.

Remember the phone: call up and put down. If you think a stock will go down, you’d buy a put option.

Again, it’s not a recommendation. It’s just to help you remember the difference.

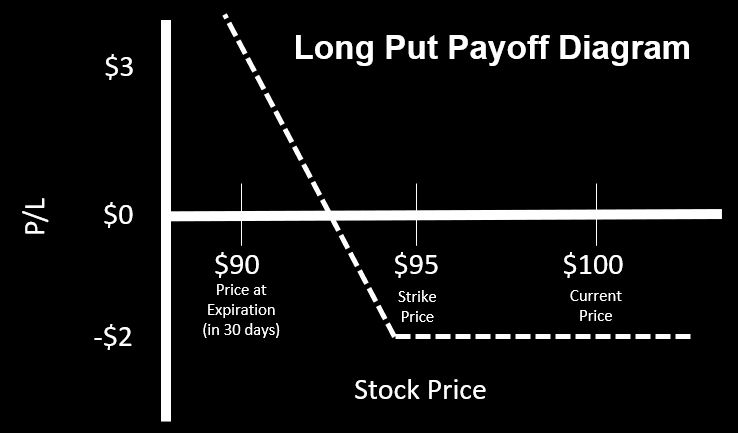

If the stock is at $100 and you think it’ll go down, you can buy a put option at $95 strike price and you’d pay $2 in premium (these are all hypothetical numbers).

If at expiration, the stock is at $90, you have the right to sell 100 shares at $95 even though it’s trading at $90. Remember, you paid a premium of $2 to the option seller to have this right.

By buying a put option on a stock you own, you essentially bought insurance on the stock. This is known as a “protective put.”

A real-world example of the put option is similar to buying insurance on a car. If you don't crash your car, you end up losing just the premium. However, if you do crash your car, you can sell your car to the insurance company (after the deductible).

Again in this scenario, the insurance buyer has the right, but not the obligation to file an insurance claim. If there was no claim, or if the damage wasn't severe enough, they wouldn't file the claim and the insurance company keeps the premium. However, if there is an insurance claim, the insurance company becomes obligated to keep their end of the deal (as they collected a premium to accept the obligation to buy the stock at the lower price).

Similar to a call option, you can actually just sell the option contract in the open market without needing to exercise the option to lock in your profit.

For example, if you don’t own the stock, and if you bought a put option, you can sell the option contract to another market participant.

If the stock is above $95 at expiration, you would’ve just lost your ‘insurance premium’ (as in, the car did not crash and there was no insurance claim). If the stock is below $95 at expiration, you can exercise your option to sell 100 shares at $95 (as in you've filed an insurance claim).

There you have it. We just covered the very basics of call and put options. We also walked through a few examples. As there are many important factors that go into options trading (which was not covered in this article), make sure to subscribe below so you’ll get notified when new articles are published.

If you want to learn more about option selling to help you retire early, we have a comprehensive, easy-to-understand video course that'll help you trade options the right way. Click the link below to try our course and community risk-free (we have a 60-day money-back guarantee).

I’d love to help you in any way I can - use me as a resource and ask me questions!

Thank you for reading, and cheers to your financial success!

Follow me on Instagram: @RealVijayKailash

Connect with me on LinkedIn: Vijay Kailash, CFA

Vijay Kailash, CFA

Founder & Lead Instructor at OptionSellingSecrets.com

Learn more about options - Join our course and mastermind to fast track yourself to financial independence!

Sign up to get our FREE email mini-course. In the course, you will learn:

- What is the stock market?

- Which stocks should you invest in?

- How much should you invest?

- How to retire early (yes, it's possible, and it's easier than you may think).

- How to use options safely to reduce risk and produce income.

We hate SPAM. We will never sell your information, for any reason.